41500 a year is how much an hour – When it comes to understanding your salary, knowing how much you earn per hour is crucial. In this article, we’ll delve into the calculation of hourly wages from an annual salary of $41,500, exploring industry comparisons, budget planning, career advancement, and more.

Let’s dive right in and uncover the details of your hourly earnings.

Annual Salary Breakdown

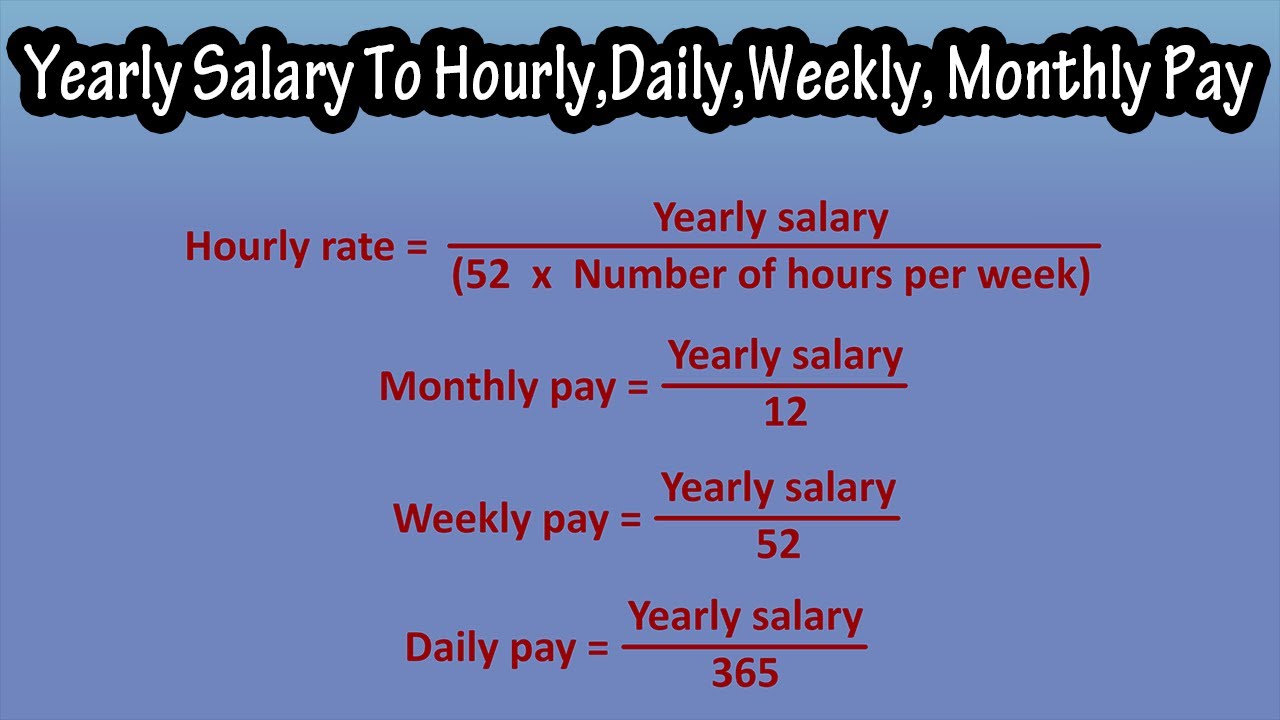

To calculate your hourly wage from an annual salary of $41,500, follow these steps:

- Divide your annual salary by the number of hours worked per year.

- The result is your hourly wage.

For example, if you work 40 hours per week, 52 weeks per year, your total number of hours worked per year is 2,080. Dividing $41,500 by 2,080 gives you an hourly wage of $20.

Factors Affecting Hourly Earnings

Factors that may affect your hourly earnings include:

- Overtime pay: If you work more than 40 hours per week, you may be eligible for overtime pay, which is typically 1.5 times your regular hourly wage.

- Benefits: Some employers offer benefits such as health insurance, paid time off, and retirement plans. These benefits can increase your overall compensation, even if they do not directly affect your hourly wage.

Industry and Job Comparisons: 41500 A Year Is How Much An Hour

Individuals earning an annual salary of $41,500 fall within the mid-range of earners in the United States. This salary is prevalent in various industries and job roles, influenced by factors such as experience, skills, qualifications, and location.

Across different industries, the same job title may command varying salaries. For instance, a software engineer in the tech industry typically earns more than a software engineer in the healthcare sector.

Common Industries

- Education: Teachers, counselors, and administrators in public schools.

- Healthcare: Nurses, medical assistants, and healthcare technicians.

- Retail: Sales associates, customer service representatives, and managers.

- Hospitality: Hotel clerks, restaurant servers, and event coordinators.

- Nonprofit: Program coordinators, social workers, and fundraisers.

Hourly Wage Comparisons

The hourly wage for similar positions can vary based on industry and location. In general, urban areas tend to offer higher wages than rural areas.

- Registered Nurse (RN): $27.45 per hour (national average)

- Software Engineer: $34.94 per hour (national average)

- Customer Service Representative: $17.89 per hour (national average)

- Retail Salesperson: $12.92 per hour (national average)

Experience and Qualifications

Experience and qualifications play a significant role in determining salary. Individuals with more experience and specialized skills tend to earn higher salaries.

- A registered nurse with 5+ years of experience may earn $30 per hour.

- A software engineer with a master’s degree may earn $40 per hour.

Budget Planning and Financial Implications

Living on an annual salary of $41,500 requires careful budget planning and financial management. This involves allocating funds for essential expenses, savings, and discretionary spending to ensure financial stability and achieve financial goals.

Who knew that something unexpected could be so impactful? Check out what something unexpected might do nyt to discover how it can spark creativity, inspire innovation, and even lead to life-changing decisions.

Essential Expenses, 41500 a year is how much an hour

Essential expenses are those that are necessary for survival and well-being. These include:

- Housing (rent or mortgage payments, property taxes, utilities)

- Food (groceries, dining out)

- Transportation (car payments, gas, public transportation)

- Healthcare (health insurance, doctor visits, prescriptions)

- Childcare (if applicable)

Savings

Savings are crucial for financial stability and achieving long-term goals. It is recommended to save at least 10-20% of your income each month. This can be used for:

- Emergency fund

- Retirement savings

- Short-term savings goals (e.g., down payment on a car)

Discretionary Spending

Discretionary spending is what remains after essential expenses and savings have been allocated. This can be used for:

- Entertainment (movies, dining out, travel)

- Hobbies and interests

- Personal care (haircuts, gym membership)

- Shopping (clothes, electronics)

Strategies for Maximizing Financial Stability

To maximize financial stability and achieve financial goals, consider the following strategies:

- Track your expenses to identify areas where you can cut back.

- Negotiate lower interest rates on loans and credit cards.

- Explore additional income streams to supplement your salary.

- Consider consolidating debt to reduce monthly payments.

- Seek professional financial advice if needed.

Career Advancement and Salary Growth

Earning $41,500 annually provides a solid foundation for career advancement. With the right strategies, individuals can unlock their potential and increase their earning capacity significantly.

To achieve career growth, it’s essential to identify potential paths and develop skills that align with industry demands. Understanding industry trends and projections can also guide career decisions and enhance earning potential.

Potential Career Paths

- Management:With experience and leadership skills, individuals can advance to supervisory or managerial roles with higher salaries.

- Specialized Roles:Developing specialized skills in areas such as finance, marketing, or technology can lead to higher-paying positions.

- Entrepreneurship:Starting a business can offer significant earning potential but also requires risk-taking and hard work.

Developing Skills and Experience

To increase earning potential, individuals should focus on developing skills that are in high demand within their industry.

Looking for the perfect game night experience? Explore best games for game night adults to find a wide range of options that cater to different tastes and preferences. From classic board games to modern card games, there’s something for everyone to enjoy.

- Technical Skills:Mastering specific software, programming languages, or industry-related technologies.

- Soft Skills:Enhancing communication, interpersonal, and problem-solving abilities.

- Certifications and Education:Obtaining industry-recognized certifications or pursuing higher education can demonstrate expertise and boost earning potential.

Industry Trends and Projections

Staying informed about industry trends and projections can help individuals make informed career decisions and prepare for future opportunities.

- Growing Industries:Identifying industries with high growth potential can lead to better job prospects and higher salaries.

- Emerging Technologies:Embracing emerging technologies and developing skills in those areas can enhance career advancement opportunities.

- Salary Projections:Understanding industry-specific salary projections can help individuals set realistic career goals and negotiate salaries effectively.

Ultimate Conclusion

Understanding the relationship between your annual salary and hourly wage is essential for effective financial planning and career growth. By considering factors such as industry norms, experience, and career goals, you can optimize your earnings and achieve your financial aspirations.

Remember, the journey to financial empowerment starts with understanding your income.

Q&A

How many hours per week do I need to work to earn $41,500 annually?

Assuming a 40-hour work week, you would need to work approximately 52 weeks per year to earn $41,500.

What factors can affect my hourly earnings?

Factors such as overtime pay, benefits, experience, skills, and location can influence your hourly earnings.

How can I increase my earning potential?

Developing valuable skills, gaining experience, and pursuing career advancement opportunities can help you boost your earning potential.